J.D. Power Asia Pacific 2010 Malaysia Sales Satisfaction Index (SSI) Study released

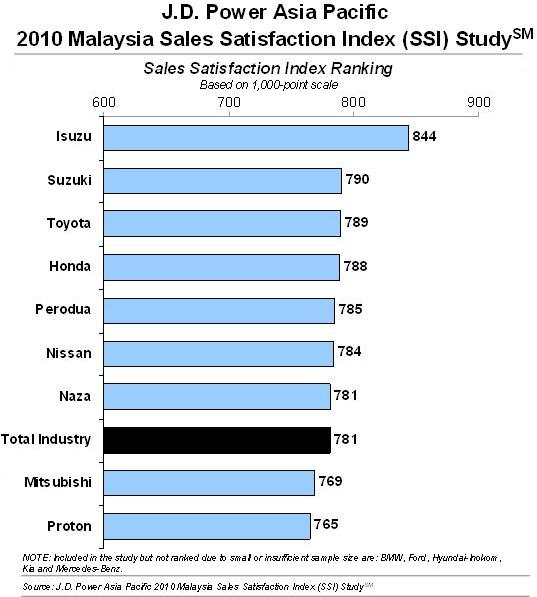

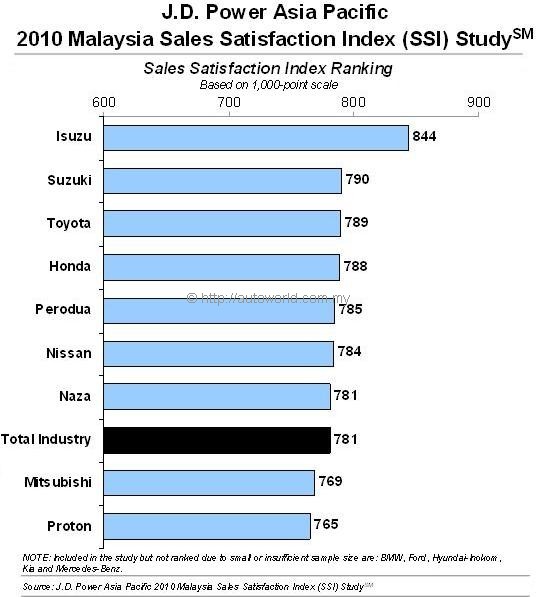

Results of the J.D. Power Asia Pacific 2010 Malaysia Sales Satisfaction Index (SSI) Study was released yesterday, with Isuzu topping the overall charts having picked up 844 points in an index scoring system based on a 1,000-point scale.

The study covered a sample size of some 2,445 new vehicle owners who purchased their cars between Sept 2009 and April 2010. A total of nine vehicle brands were considered in the study, with the industry average coming to a score of 781.

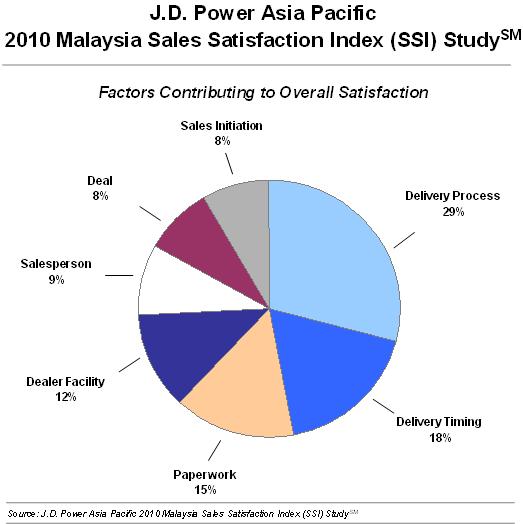

This study is not to be confused with the earlier published Customer Service Index (CSI) study also performed by J.D. Power Asia Pacific which focused on after-sales service. The SSI study here looks into the actual sales and delivery process, with a total of seven factors contributing to the overall score.

In order of importance, the evaluated factors for this study are: delivery process; delivery timing; paperwork; dealer facility; salesperson, deal and sales initiation. As you would expect, sales satisfaction correlates strongly with delivery times, and J.D. Power found that the strong decline of customer satisfaction occurs when delivery time exceeds 14 days.

|

The average delivery time in the industry is 19.8 days in 2010, up two days from 17.8 in 2009. Approximately 20% of customers surveyed indicated that they received their cars within four days of booking, and among these customers, satisfaction with delivery timing averaged 52 points above the industry average.

“In order to ensure high customer satisfaction, it is crucial for dealerships to improve on the delivery timing and ensure that the vehicles are delivered as requested and at the promised time,” said Taku Kimoto, general manager for Malaysia at J.D. Power Asia Pacific, Singapore.

Isuzu topped the charts for the second year running, and was followed by Suzuki (790), Toyota (789) and Honda (788). Naza is now on par with the industry average at 781, a notable increase from 736 in 2009. Mitsubishi and Proton were notably below average at 769 and 765 respectively.

|

“As competition intensifies and customer expectations rise, ensuring that customers are delighted with their new-vehicle sales experience at the dealership is vital, as this may have a particularly strong positive effect on future loyalty and advocacy intentions,” said Kimoto.