No reduction in automotive excise duties

In recent months, we’ve often been asked by people around us, when are prices of cars coming down in this country? Well, the simple answer to this is not anytime soon. In a press conference organized by the Ministry of International Trade & Industry (MITI) yesterday, CEO of the Malaysia Automotive Institute (MAI) Madani Sahari’s simple message to the public is to not withhold their purchases in anticipation of a sharp drop in prices simply because it would not happen.

Citing the need to protect residual values of second-hand vehicles among other things, Madani pointed out that reduction of motor vehicle prices in the country need to take place gradually so as not to leave an estimated 100,000 pre-owned vehicles in limbo trapped in the stockyards of used car dealers. The Government’s current pledge is to have car prices reduced by about 20 to 30% in a time span of five years, give or take.

Cars sold in Malaysia are subject to a three-pronged taxation system consisting of import duty, excise duty, and sales tax. Import duty does not apply to ASEAN-sourced vehicles, but beyond that, say if your vehicle or its CKD packs come from Europe, Japan, or Korea, CKDs pay 10% and CBUs pay 30%. Every car regardless of origin pays 10% sales tax without exception, and this leaves us with excise duties as the remaining point of contention.

Commercial vehicles are not subject to excise duties, which explains why pick-up trucks like the Toyota Hilux and Mitsubishi Triton are so much cheaper than their mechanically equivalent SUVs, namely the Fortuner and Pajero Sport respectively. Everyone else however, and this includes Proton and Perodua, pay excise duties between 60% and 105% depending on vehicle type and engine capacity.

Sources in various automotive companies tell us that the process of calculating excise duties for cars is actually very tedious and requires extensive documentation that itemizes the cost of each component within the vehicle. This is one reason why many manufacturers are reluctant to offer spec customization options to Malaysian consumers. It might be as simple as ticking a box on a checklist for the consumer, but for the car companies, it is a lengthy paper trail of documentation that they are not at all keen to follow.

Whilst the original intention of high motor vehicle taxes was to protect the local automotive industry, it has also turned into a very lucrative source of income for the Government. International Trade and Industry Minister Datuk Seri Mustapa Mohamed was quoted as saying that Malaysians contributed a total of RM7 billion to the Government’s coffers through automotive taxes alone last year. No government will sacrifice that kind of revenue, let’s be frank about this.

So, how does the Government plan to bring car prices without reducing excise duties? The answer, Madani claims, lies in market liberalization and the promotion of local assembly operations within the country. He explained that incentives are actually in place allowing companies that perform local assembly and value-added activities within the country to receive rebates that effectively reduce excise duties to about 40%, which Madani claims is on par with Thailand and Indonesia.

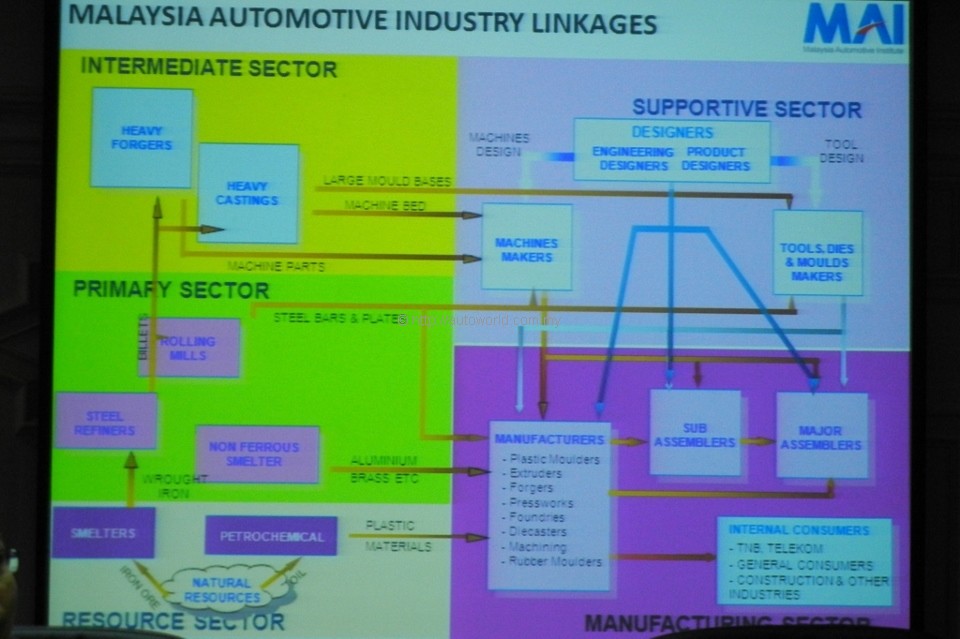

Madani further explains that the Government’s strategy to promote local-assembly within the country and stimulate supporting industries through transfer of technology and R&D activities. Years of protectionist and flip-flop policies may have sent many automakers flocking into Thailand’s welcoming arms, but the Government now hopes to focus its strategy into making Malaysia a regional assembly hub for Energy Efficient Vehicles, a very amusing goal to proclaim for a country that still drags its feet in raising its fuel quality.

The specific definition of an Energy Efficient Vehicle has not been made clear in this context, but we understand that it would be determined by a ratio of the vehicle’s fuel consumption relative against its kerb weight. Vehicles that meet this definition of an EEV will get to enjoy certain unspecified tax benefits. Currently, hybrid vehicles displacing less than 2,000cc get full exemption of import and excise duties. A special case was granted to BMW’s 3.0-litre ActiveHybrid 3 and ActiveHybrid 5 models, both of which received 50% reduction in their import and excise duties in view of BMW’s investments setting up CKD operations for the 3 Series and 5 Series models.

The majority of brands that do business in Malaysia do actually operate CKD operations in some form or another. Two reasons spur this, first of them being the aforementioned tax incentives that help lower excise duties and thus facilitate competitive pricing. The second and perhaps more crucial reason is that a company that sells only CBU vehicles are restricted in the number of cars that can be sold by the number of APs issued to them from the Government.

APs, or Approved Permits, are divided into two categories – Open APs and Franchise APs. Open APs are what make the grey import business possible, and we will leave that discussion for another day. For now, suffice it to say that the Government issues a limited number of APs every year, and that number is simply 10% of the total number of vehicles assembled locally in the preceding year.

Taking 2012 for example, when the local industry rolled out a total 569,620 cars, it means that there are only 56,962 APs going around the whole industry for the whole of this year. This total is then split in a 60:40 ratio between open and franchise APs. This essentially means that there are only 22,784 franchise APs to go around for all of the official distributors combined; which consequently means that when a brand reaches a certain critical volume, it will be forced to adopt local assembly or live with stagnating sales and unfulfilled orders in their books.

Different companies operate different levels of local assembly operations here in Malaysia. Some take the effort of extensive parts localization and developing the capabilities of local suppliers, whilst others ship over almost completely built-up vehicles here only to have their doors attached and seats wrapped. We have been told by representatives of several brands that locally-assembled vehicles can actually cost more per unit compared to imported models even with shipping costs factored in due to the poor economies of scale in our country – which is why Honda had to remove equipment from the Jazz Hybrid in order to facilitate a price reduction for the CKD version that was introduced late last year.

The local automotive industry has grown to become a complex ecosystem shaped by three decades of protection to the local players, and the effects of these policies will take more than a mere five years to reverse. A sudden reduction in prices is understandably not an option, and we certainly do not advocate this approach either. The Government’s stand that it would not reduce excise duties from its present levels mean that the buck is now passed on to the industry players to fulfill the Government’s promises at the expense of their own margins.

Writer’s Note: For further reading on this topic, we highly recommend the editorial from Hans Cheong of Live Life Drive accessible from the link below.