Flux Makes A Case For A New Type Of Car Ownership Via Subscription

Flux is a multi-brand car subscription service that offers vehicle ownership flexibility to Malaysians. Flux has launched “Subscribe to Own”, a new product that makes car ownership simple, seamless and financially accessible. Flux offers an all-inclusive service where you not only get a car, but Flux will cover the insurance, road tax, maintenance as well as wear & tear. Flux will even provide a concierge service to handle the administrative chores so that all you need to do is to enjoy the drive.

Flux is a multi-brand car subscription service that offers vehicle ownership flexibility to Malaysians. Flux has launched “Subscribe to Own”, a new product that makes car ownership simple, seamless and financially accessible. Flux offers an all-inclusive service where you not only get a car, but Flux will cover the insurance, road tax, maintenance as well as wear & tear. Flux will even provide a concierge service to handle the administrative chores so that all you need to do is to enjoy the drive.

The Flux “Subscribe to Own” option allows you to initially subscribe to a new or pre-owned car from the Flux collection, with the option to purchase it at the end of your subscription. You can enjoy all the benefits of the standard Flux service, but with this new product, your monthly subscription payments can now also contribute towards the option to purchase the car.

How It Works

Flux’s “Subscribe to Own” works similarly to the Flux that consumers are familiar with. You choose your subscription plan (either 12, 24 or 36 months) and mileage package (1,250 km, 2,000 km or uncapped mileage per month) for a particular car. Based upon the car and subscription plan you have selected, Flux then sets a unique Guaranteed Future Value¹ (GFV) for which you can purchase the car at the end of the subscription period (i.e. the shorter the subscription, the higher the GFV).

¹ GFV: The guaranteed price that a Flux member can purchase the car for, at the end of their subscription.

Flux also offers a month-to-month subscription plan (i.e. pay as you go) for even greater flexibility without the “Subscribe to Own” option.

The GFV is predetermined and transparently displayed online during the checkout process. There will therefore be no need for the hassle of negotiations. You will have up to 30 days prior to the end of your subscription before to decide on exercising the purchase option, giving you maximum flexibility.

The GFV is predetermined and transparently displayed online during the checkout process. There will therefore be no need for the hassle of negotiations. You will have up to 30 days prior to the end of your subscription before to decide on exercising the purchase option, giving you maximum flexibility.

Flux’s GFV includes the processing fees for the transfer of ownership (i.e. Puspakom & JPJ), but excludes road tax and allows you the option to purchase the insurance of your liking. As always, Flux’s concierge will handle the entire process so that you can just sit back, relax and wait for your newly purchased car to be delivered to your doorstep.

On top of the flexibility and convenience, there are several financial benefits to choosing “Subscribe to Own” when buying your next car:

Low Upfront Fees

When subscribing to own with Flux, you no longer need to pay a downpayment like you would with a conventional car loan. Instead, Flux charges a start fee, which is at least 50% lower than the average downpayment. This will help to ease your cash flow in your first year of ‘ownership’.

No Surprise Expenses

With Flux, the maintenance, and wear and tear costs are included in one simple subscription fee. Thus, you will no longer get surprise expenses such as replacement of incidentals such as tyres and brake pads. This allows you better visibility and opportunity for effective financial management.

Protect Your Credit Score

A Flux subscription will not affect your credit score. You are therefore able to maximise your credit resources towards other big ticket spending, such as buying a home. This is perfect for first-time home buyers who have yet to build credit history.

Avoide Residual Value Losses

Depreciation on a car can be unpredictable and will depend on various factors outside your control. Flux’s GFV can help to mitigate the risk of variable market prices. You can also enjoy the full transparency of the value of your car at the end of your subscription.

Never Get Stuck With A Lemon

All the vehicles in the Flux collection are independently inspected to ensure that you will receive only the best quality. With Flux’s 3-day Risk-Free Return policy, you can switch out your Flux car at the start of your subscription so that you will never be stuck with a problematic car.

Switch Your Car To Fit Your Budget

With a Flux subscription, you will always have the option to switch cars as your needs evolve or when your budget changes. When times are tough, you have the choice to downgrade to a more economical compact car. In good times, you can enjoy life with a luxury coupe. The choice is yours to adjust your car expenses according to your budget.

Subscribe To Own vs Car Loan

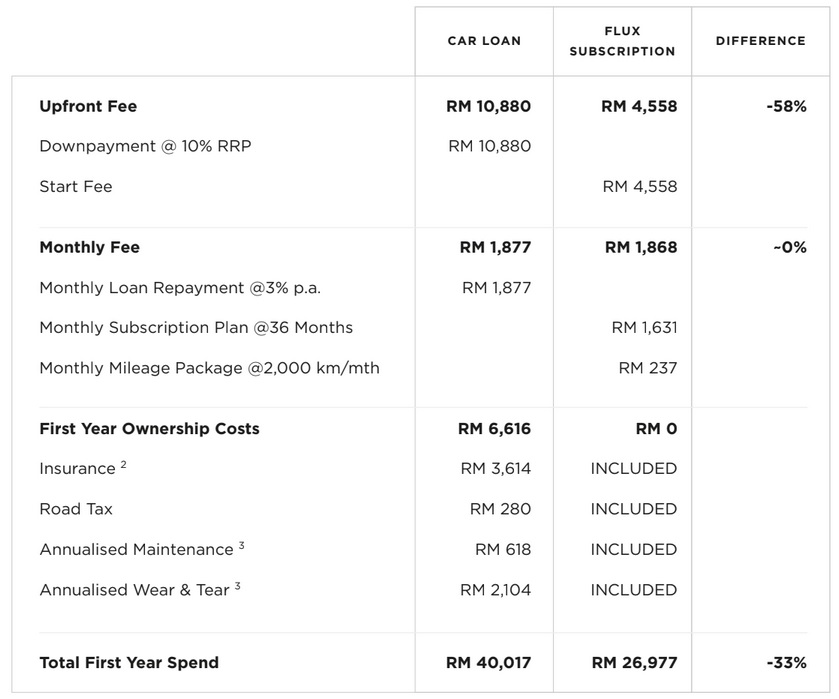

The following is an example of the finances involved in engaging Flux’s “Subscribe to Own” compared to a 5-year car loan, using a brand new Honda HR-V E variant with a retail price of RM108,800 as an example. The analysis shows your total spend via a 5-year loan (at 3% per annum interest rate) versus the Flux 36 Months Standard subscription, with a GFV which the Flux member can purchase the vehicle for, after the 36-month period.

² Comprehensive insurance inclusive of special peril and windshield coverage

² Comprehensive insurance inclusive of special peril and windshield coverage

³ Source: Authorised Honda Service Center and Indepedent Workshops

In this example, you can save up to 33% on your first year’s total spend. This saves you from having to pay out a large initial amount at the start of your car ownership.

At the end of the 36-month subscription period, as a Flux member, you have the option to purchase the car based upon the predetermined GFV. With the Flux GFV, you can mitigate the risk of market price fluctuations. This Honda HR-V example shows that currently Flux’s GFV is 9% below forecasted market prices. 4 Source: Analysis of Carlist Malaysia

4 Source: Analysis of Carlist Malaysia

In order to make this directly comparable, the analysis benchmarks the total cost of ownership for the first 3 years, as the 4th and 5th years are identical for both options. For the Flux costing, interest charges have been included when purchasing the car after the 3rd year.

* = Annualised ownership costs multiplied by 3. Insurance cost for Y2 and Y3 is based on NCD 25% and 30% respectively

* = Annualised ownership costs multiplied by 3. Insurance cost for Y2 and Y3 is based on NCD 25% and 30% respectively

With “Subscribe to Own” by Flux, you will pay 6% more than the traditional car loan. This translates to an extra RM131 per month across the 5-year period. But with this premium, Flux subscribers pay 58% lower upfront fees and enjoy the following benefits:

Flexibility And Convenience By Flux

Flexibility And Convenience By Flux

Flux offers flexibility in financing your car with unmatched convenience and utility. One subscription plan will offer you access to all of its cars, without any long-term commitment or financial rigidity. As a service, Flux is perfect for

- home buyers looking to maximise their credit

- expats who find it diffcult to get a car loan

- business owners who want to manage their cash flow in the early years

- financially astute consumers who want greater flexibility in their car expenses.

“In today’s current economic climate, consumers need to have better visibility and control of their financial management. Especially when it comes to big ticket purchases such as a car. “Subscribe to Own” by Flux not only allows you to better manage your car expenses, but it also lowers the barrier to entry for car ownership,” said Aziz Ayman, Founder & CEO of Flux.

“In today’s current economic climate, consumers need to have better visibility and control of their financial management. Especially when it comes to big ticket purchases such as a car. “Subscribe to Own” by Flux not only allows you to better manage your car expenses, but it also lowers the barrier to entry for car ownership,” said Aziz Ayman, Founder & CEO of Flux.

“With Flux, gone are the days where you have to spend tens of thousands of Ringgit on a 10% to 20% downpayment. Instead, consumers spend a fraction upfront via a Flux subscription and can still own the car at the end of the day. This new financial product allows car buyers to spread their expenditure more evenly across the ownership journey, whilst still having the flexibility to decide on owning the car in the long-run. Why lock yourself in a long-term, rigid financial commitment, when you can enjoy the freedom of choice and lower upfront fees with Flux,” he added.