New Motor Vehicle Tax Structure Announced by Ministry of Finance

New Import Duty & Excise Duty Structure Announced by Malaysian Government

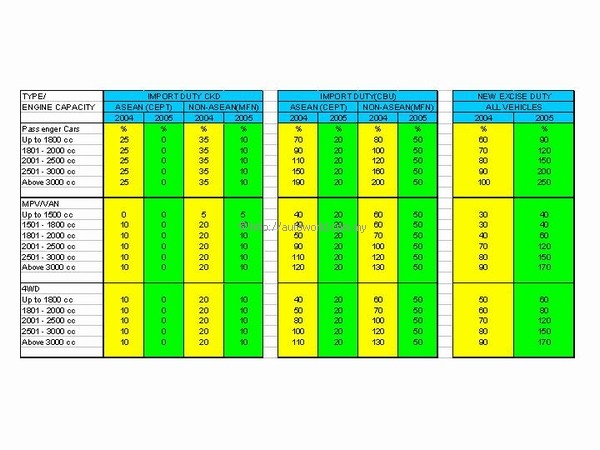

Kuala Lumpur 24th December 2004 – The Ministry of Finance Malaysia announced the new import duty and excise duty structure affecting all CKD (Completely Knocked Down) vehicles, and CBU (Completely Built-Up) vehicles, effective 1st January 2005.

A statement released by the Ministry of Finance stated, “ In line with Malaysia’s commitment under AFTA, the import duty on all categories of motor vehicles imported from ASEAN countries will be reduced to 20 percent effective 1 January 2005.”

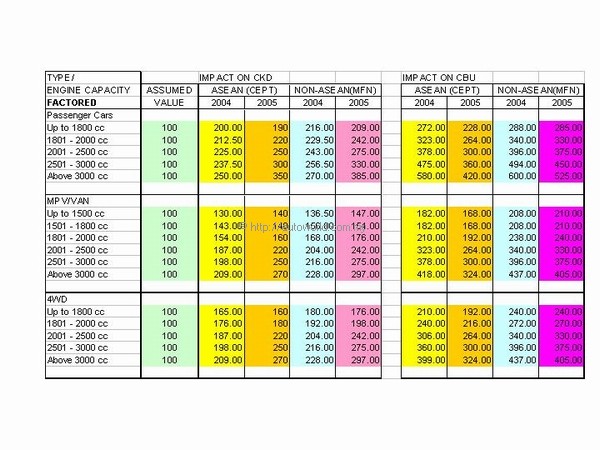

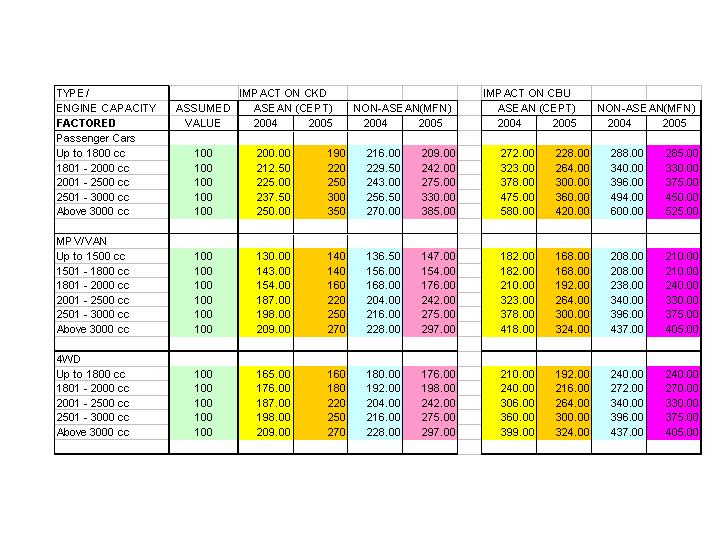

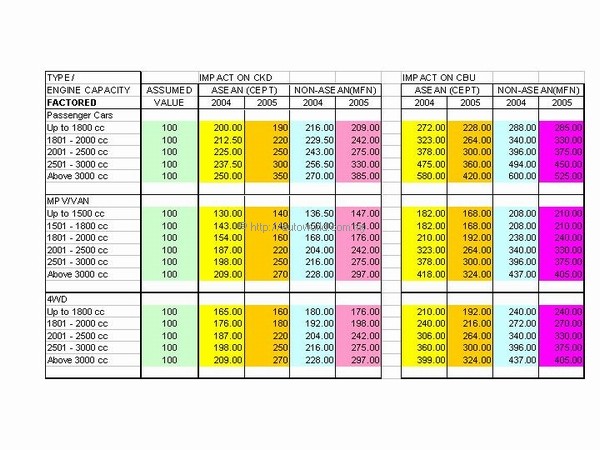

The net effect of the tax structure on motor vehicles, taking into account both the changes in import duties and excise duties, is as follows:-

1) For CBU motor vehicles from Asean, there will be a reduction

2) For CBU motor vehicles from Non-Asean, there will be no change; and

3) For locally manufactured and assembled motor vehicles, there will be an increase.

The release also stated, “For a period of six months, i.e. from 1 January until 30 June 2005, the automotive industry has the option of using either the current tax rates or the new tax rates. This transitional arrangement is mainly to enable them to clear the stocks as was done in the 2004 exercise.”

“To ensure the longer term viability of the local automotive industry, as well as to maintain stability of motor vehicle prices in Malaysia, the Government will extend to the local automotive industry similar fiscal incentives that have been provided to other sectors of the economy. On this basis, the Government does not expect major price changes in the cars produced or assembled in Malaysia during 2005.”

|

|

Impact of the New Tax Structure – Our Opinion

What is the impact of the new tax structure? The backroom boys at Autoworld got to work to analyze the figures, and work out the impact.

To compare apples to apples, we set a value of RM100, and applied the current 2004 tax structure to come up with a value. We then took the same amount and applied the 2005 tax structure.

Assuming that manufacturers do not increase their prices for 2004, our quick readings indicate the following:-

1) CKD cars of up to 1800 cc imported from Asean (CEPT), and assembled here should go down by 5 percent. Affected vehicles would be the Honda City, Toyota Vios,

2) CKD cars of up to 1800 cc imported from Non-Asean countries and assembled here would go down by approximately 3 percent. Affected vehicles would be Toyota Altis, Ford Lynx, Nissan Sentra, and Mercedes Benz C-class.

3) CKD cars of 1801 – 2000 cc imported from ASEAN and assembled here would go up by 3 percent, while those from non-ASEAN would go up by about 5 percent.

4) CKD cars of 2001 to 2500 cc imported from ASEAN and assembled here would go up by 11 percent, while those from Non-Asean would go up by 13 percent.

5) CKD cars of 2501 to 3000 cc imported from ASEAN and assembled here would go up by 26 percent, while those imported from Non-ASEAN would go up by 26 percent.

6) MPV/Vans of up to 1500 cc imported as CKD from ASEAN would go up by 7.6 percent, while those imported from non-ASEAN would go up by the same amount. Affected model would be the Toyota Avanza, Hyundai Matrix, Honda Jazz.

7) MPV/Vans of 1501 to 1800 cc imported as CKD from ASEAN and non-ASEAN are not affected, and cost actually goes down very slightly.

8) MPV/Vans of 1801 to 2000 cc imported as CKD from both ASEAN and non-ASEAN would go up about 3 percent.

9) MPV/Vans of 2001 cc and above are badly hit, with increases from 17 percent to 30 percent.

10) 4WD vehicles in the lower categories up to 1800 cc are slightly lower in cost, while the higher categories are likely to increase from 2 to 30 percent, with the vehicles above 2500 cc being the worst hit.

11) All imported vehicles (CBU) actually become cheaper, except for imported MPV/Vans. MPV/Vans imported as CBU from ASEAN will be cheaper by between 8 to 10 percent. Vehicles with increased costs would be the Chevrolet Nabira, Honda Jazz, Honda Stream, Honda Odyssey. It would be entirely up to the importers whether they absorb this increase or pass it onto the customer. Cars imported from ASEAN would go down by 5 percent to as much as 20 percent, depending on the cubic capacity. Cars imported as CBU from non-ASEAN will see a reduction in cost ranging from zero to twelve percent.

Impact of the new tax structure on the Regional Automotive Industry.

The following are our predictions regarding the new tax structure:-

1) Auto makers will re-evaluate their range of vehicles, and look for new market opportunities within the tax structure. They will most likely go for models that attract a lower total tax structure.

2) Auto makers will also look at their current manufacturing mix, and will rationalize their production to place their plants and models produced in each plant to find economies of scale and efficiency. This could lower the cost of production for specific models, and lower prices.

3) In the short term, there will be uncertainties, but in the long term, the auto industry will stand to grow. Car buyers will benefit from better quality cars.

Impact of the new tax structure on the National Car Industry.

The national car makers will continue to get some form of assistance, as stated in the press statement released by the Ministry of Finance. No details are available at the moment. Without any assistance, the national cars would go up substantially, since they would get zero relief from any reduction in import duty, but would have to pay increased excise duty instead.

Clearly, the National makes would have to be more competitive in the years to come. The war is not lost yet; these are some of the actions that can be put into action:-

1) Get economies of scale through increasing volume. This is possible by looking beyond our shores into the export market. However, there are several stumbling blocks in this direction; issues pertaining to quality, and price competitiveness need resolving.

2) Tying up with foreign car makers to expand the market for our cars. Re-badging of our local models or contract manufacturing for other makes is a possible option.

3) Reduce costs by increasing the efficiency of the local parts suppliers. One possible way to do this is to encourage local suppliers to invest in better tooling and equipment, and to do R & D to improve production and quality, bearing in mind that in order to invest, the suppliers need certain commitment to volumes.

Impact on the Malaysian Car buyer

It is clear that there will be no real drop in the prices of cars, and if there was any reduction, inflation would probably negate it anyway. Looking at the trend of car prices for the last 40 years, one should see the writing on the wall.

Many reader and AW forum members are expressing disappointment that the prices are not dropping with AFTA, but can you imagine the scenario if car prices are slashed by a huge amount overnight in this country? What would happen to the car that you are currently driving? Used car values would plunge, and if you are still paying installments, the hire purchase company would want you to top up your payments immediately so that you do not owe more than the reduced value of your car. Multiply this by four hundred thousand owners who bought their cars this year alone, plus the four hundred thousand who bought their cars last year, and the million or so who bought their cars three years before that, and you will have a big financial crisis that will drag the economy down the drain. Scary, isn’t it?